What Does Property By Helander Llc Mean?

What Does Property By Helander Llc Mean?

Blog Article

How Property By Helander Llc can Save You Time, Stress, and Money.

Table of ContentsHow Property By Helander Llc can Save You Time, Stress, and Money.Property By Helander Llc Can Be Fun For EveryoneWhat Does Property By Helander Llc Mean?The Single Strategy To Use For Property By Helander Llc

The difference in between the price and the price you paid to purchase will be the capital gain, which will certainly be taxed, yet just in the year that you throw away the property. Genuine estate isn't subject to the same volatility as other sort of financial investments. Unlike supply trading, the property market isn't such as to have the same large over night shifts.It's a terrific addition to a more risk-averse portfolio, making it an all-around superb investment! It is necessary to keep in mind that property investment does not come without threat. The US real estate market accident of 2008 revealed investors the relevance of not over-leveraging and making wise investment choices when growing their profiles.

Rental income apart, genuine estate collects easy wealth with its intrinsic tax benefits and lasting appreciation. With the best building supervisors and rental team, the ROI on your investment comes to be fairly passive.

The 4-Minute Rule for Property By Helander Llc

Right here at BuyProperly, we take advantage of a fractional ownership design to permit financiers to purchase real estate for just $2500. This means they can get going quickly without having to wait and conserve up huge round figure deposits for investment residential properties. Intend to see just how we do it? ****Phone call to activity below *******Along with monetary costs, buying property comes with a substantial time price when you think about sourcing building dealsUnlike buying and trading stocks which can be finished with the click of a mouse, home investment typically requires even more time, research, and preparation.

On top of this, if you do not have an excellent group in area, handling your fixings, maintenance, and renters can turn into a frustrating process. Sourcing excellent offers doesn't have actually to be complicated. At BuyProperly, for instance, we have actually produced an AI-powered platform that enables investors to see, acquire, and sell realty digitally (a lot like they would trade supplies).

As much as we enjoy genuine estate for its protection and foreseeable returns, it's not the sort of investment that can be dealt swiftly. The greatest returns are gained when investors are eager to get and hold. If you assume you may require to release up money promptly, OR if you're searching for an incredibly quick earnings, real estate may not be your major investment automobile

The Main Principles Of Property By Helander Llc

Along with cash flow possibility, you can also benefit from consistent appreciation, decreased volatility, and investor tax benefits. It is necessary to bear in mind that realty is an amazing lasting financial investment, and not well matched to individuals who want instantaneous returns. It's a reputable, foreseeable property with terrific capital and ROI capacity.

You can use the income made to develop a larger real estate profile, pay regular monthly expenses or conserve for various other monetary goals. A couple of means to make passive income with actual estate financial investments consist of:: When you rent out buildings, you make easy revenue.

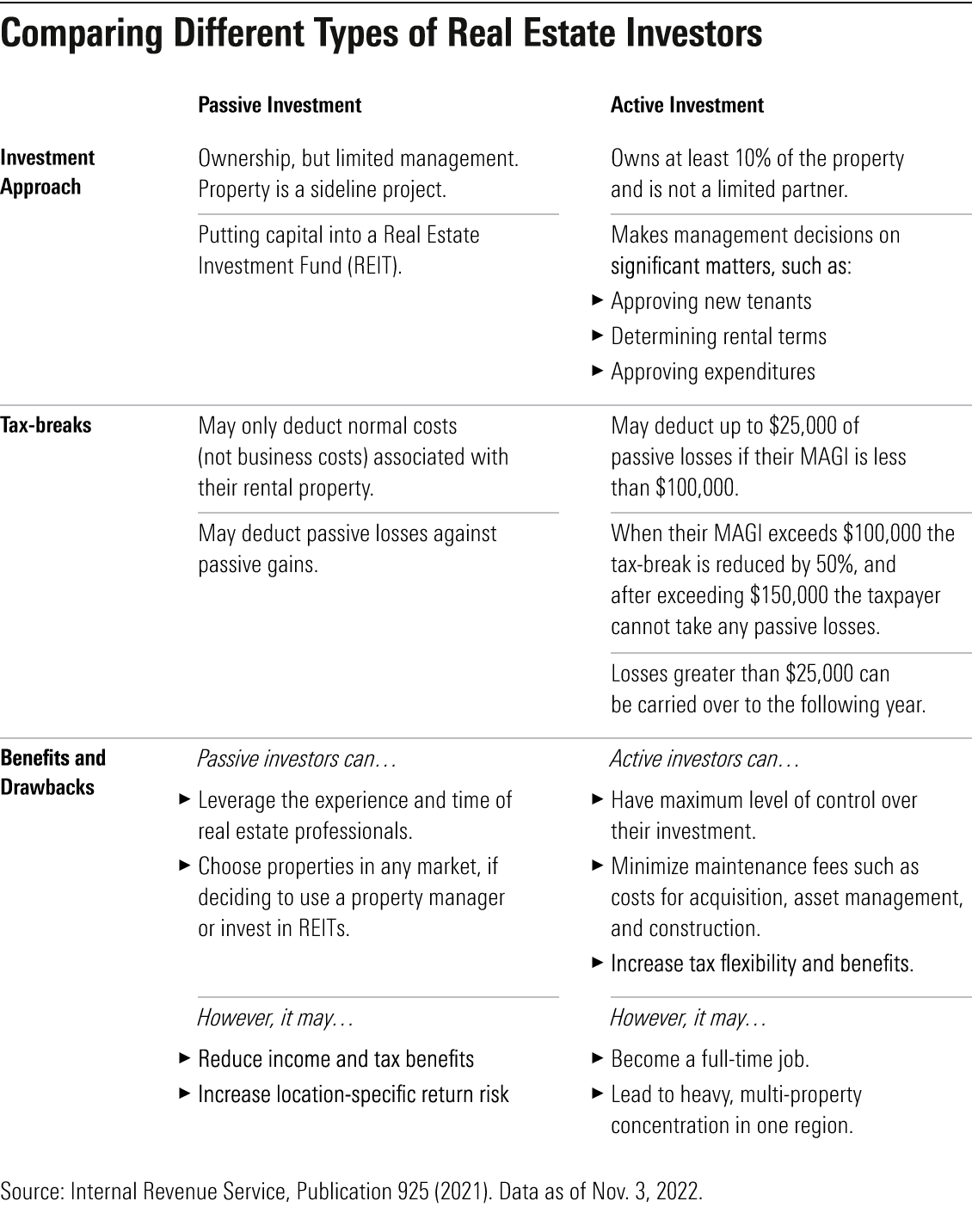

The IRS allows investors to subtract expenditures entailed in their property organization if they can verify material participation. The expenses you might be qualified to deduct include the following:: If you the original source finance investment homes, you might have the ability to deduct the rate of interest paid on the mortgage.: Real estate capitalists can often subtract depreciation for household and business buildings over their useful life (27.5 years and 39 years, specifically).

A Biased View of Property By Helander Llc

This allows you to enhance your genuine estate portfolio by spending more capital. To access the capital, you can offer the home and reinvest the funds in an additional property or make use of a cash-out refinance to access some of the home's equity, offering you with more funding to boost your genuine estate portfolio, making more revenue.

Property, nonetheless, supplies a hedge against rising cost of living since as inflation rates enhance, so do realty rates generally. This allows your investment to keep pace with inflation and you to retain the power of the dollar. Leveraging your property financial investment is one of the ideal benefits of property investing.

You should check out the program (Homes for sale in Sandpoint Idaho) very carefully for a summary of the threats related to an investment in JLL Revenue Residential Property Count On. Some of these risks include however are not limited to the following: Since there is no public trading market for shares of our usual stock, repurchases of shares by us after a 1 year minimum holding period will likely be the only method to get rid of your shares

Report this page